FAIR OAKS RANCH HOUSING REPORT MARCH 2024

Prior to my typical analysis of the market statistics, I want to address the recent National Association of Realtors (NAR) settlement that you’ve likely read about. What has been ballyhooed as a great win for homebuyers and sellers is, in actuality, nothing more than a windfall for the lawyers that brought the case.

The significant change that will, in theory become law in July, is that selling agents will no longer be able to publish buyer agent cooperative compensation on the Multiple Listing Service (MLS.) Plaintiffs argued that cooperative compensation a) artificially inflated the cost of a home and, b) it tended to have buyer agents steer clients to homes that offered greater compensation.

In regards to compensation, having the seller provide both seller and buyer client compensation enabled buyers to finance and therefore amortize their portion of the compensation over the course of the loan. This is *very* attractive to first-time homebuyers in particular, as they often struggle just to come up with down payments and closing costs. If sellers do not provide this as a concession to buyers, they will have effectively eliminated a very significant slice of potential buyers with a likely end result that housing prices, and therefore equity, will drop.

In terms of steering clients to homes with greater compensation, the pervasiveness of this is frankly very minimal. In the vast majority of instances, buyers find homes on Zillow, etc., and have their agents make the arrangements to see them. It is after visiting these homes that buyers make the decision to compensate their agents to make up any difference in what is not being offered in terms of compensation. Assuming this is enacted in July, BUYERS WILL NOT BE ABLE TO VISIT A HOME LISTED ON THE MLS WITHOUT HAVING A WRITTEN AGREEMENT WITH A LICENSED REAL ESTATE AGENT. The only exception will be for open houses.

To repeat, the only genuine winners in this case are the lawyers that brought it forth.

Now for this months statistics:

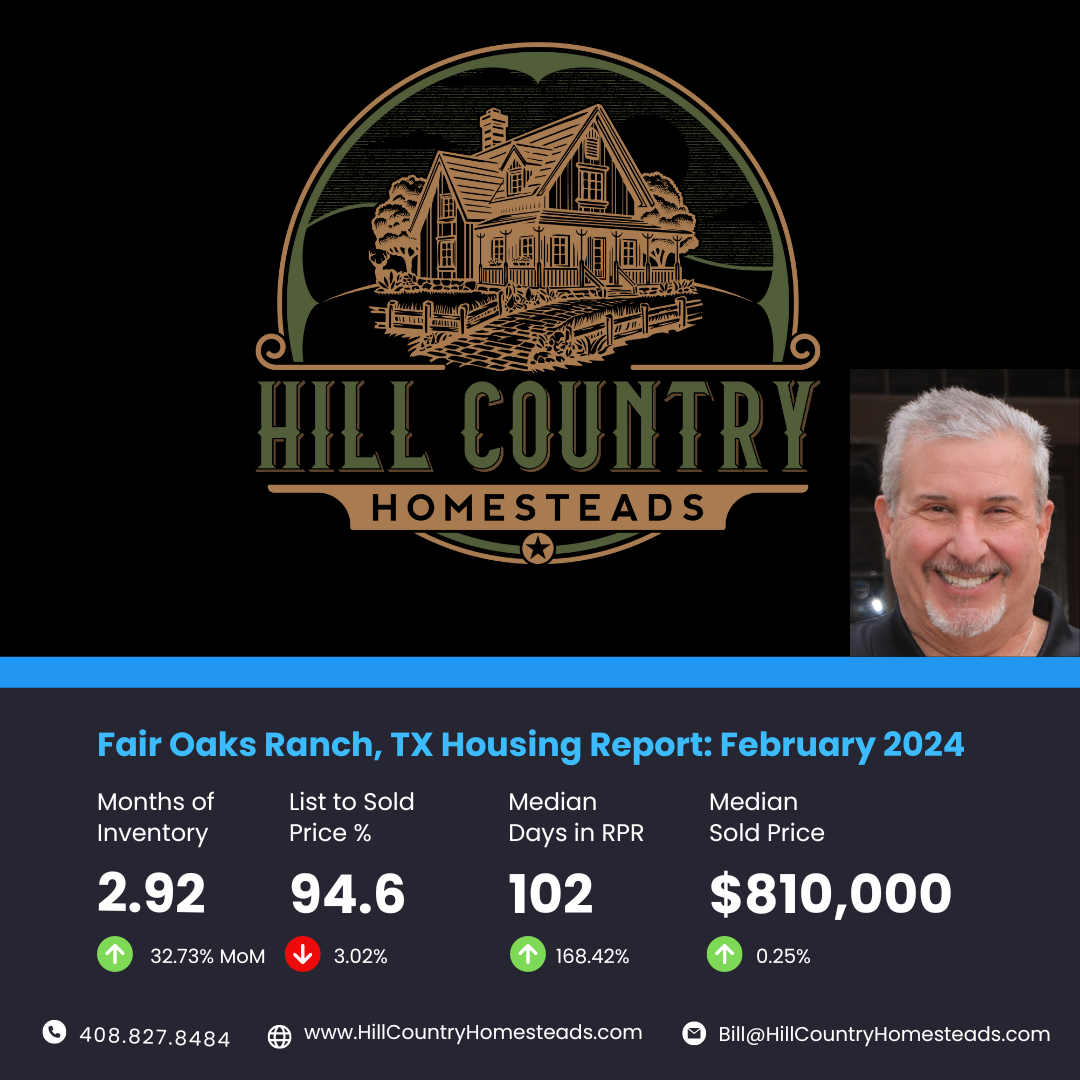

When looking at these real estate metrics, there is a clear correlation that can be seen between them. First, let's start with the Months Supply of Inventory, which is currently at 2.92. This means that based on the current rate of sales, it would take approximately 2.92 months to sell all the available inventory on the market. While still indicative of a “seller’s market,” it’s grown nearly 33% in the past month. We’re in what is typically home buying season which could be why we’re seeing [slightly] more inventory.

The 12-Month Change in Months of Inventory is showing a significant decrease of -51.58%. This indicates that the market is experiencing a decrease in the amount of time it would take to sell all available inventory, showing a trend towards a more competitive market with properties selling at a faster pace. Personally, I attribute this drop in inventory not to a hot market [it isn’t] but to one that is stagnated because of high interest rates. These rates keep many from being able to afford mortgage payments. Additionally, homeowners with low interest rate mortgages are reluctant to sell and take on a new mortgage with double the interest rate. If you are a homeowner looking to downsize and buy your new home with the equity in your current one, you should be marketing your home to out-of-state buyers that have sufficient equity in their current homes to buy yours outright, in cash. I can help you with this.

The Median Days Homes are On the Market is 102, which is a reflection of how long, on average, it takes for a home to sell. Remember during COVID when homes were on the market for hours instead of days? Well, those days are gone and now, generally speaking, you should prepare yourself for > three months to sell your home from the listing date. If your home has been on the market significantly longer, your home is either overpriced, not being marketed correctly, or both. We live in a very desirable area with nice neighborhoods, great schools, low crime and convenient shopping. If your home isn’t selling, find a new real estate agent.

The List to Sold Price Percentage is at 94.6%, showing that homes are typically selling very close to their listing price. This could indicate a strong seller's market where buyers are willing to pay close to the asking price for homes.

Lastly, the Median Sold Price is $810,000, which gives us an idea of the average price at which homes are selling in this market. Fair Oaks Ranch is in the higher-priced range for homes in the San Antonio - New Braunfels metropolitan statistical area. In other areas of the country, California in particular, this median price would be viewed as a bargain and your home would be a giant step upwards in terms of quality of life. I cannot overstate enough that if you want to sell your home in this market you must market to out-of-state buyers.

Overall, these metrics paint a picture of a competitive real estate market where homes are selling relatively quickly, often at or very close to their listing price, and at a median price of $810,000. This information can be valuable for buyers and sellers in understanding the current market conditions and making informed decisions.

The introduction about the NAR legal settlement was a light overview. If you would like to discuss it in more detail to understand how it may affect you, please reach out to me at: Bill@HillCountryHomesteads.com.